In this guide, we walk you through credit and debit card processing in Canada—How transactions work behind the scenes and the fees involved and the differences between card types.

Accepting WeChat Pay, Alipay, and UnionPay allows for businesses to connect with high-spending international customers by offering familiar payment options.

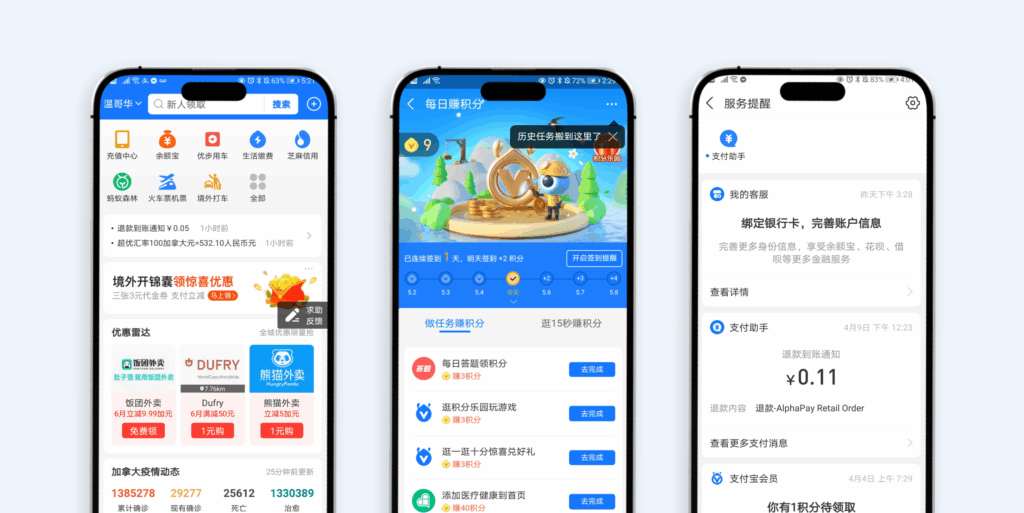

Mobile payments have redefined how customers interact with businesses globally. In China, more than 90% of in-person transactions now occur through digital wallets, not credit cards. For businesses in Canada, this presents both a challenge and an opportunity.

To serve this growing audience, more and more businesses are supporting the payment methods that customers already trust and use.

WeChat Pay: Mobile Payments Inside China’s Super App

WeChat Pay is the mobile wallet integrated into WeChat, China’s all-in-one messaging, social, and lifestyle app with over 1.3 billion users worldwide. With approximately 1.13 billion active users, WeChat Pay enables seamless money transfers, shopping, bill payments, travel bookings, and in-store purchases, all within the app.

How It Works

WeChat Pay links to a user’s bank account or credit card and enables payments via QR codes. At checkout, a user either scans the merchant’s QR code or presents one for the merchant to scan.

WeChat Pay is accepted in more than 60 countries and supports multi-currency transactions. International merchants can receive settlement in their local currency, such as CAD or USD, while the customer pays in RMB.

Canadian Businesses Adopting Wechat Pay

Retail stores in tourist-heavy areas (e.g., Vancouver, Toronto, Banff)

Cafés and restaurants

Wine and liquor shops offering in-person tastings or gift packaging

Hotels, museums, and entertainment venues

Notable Features

Mini-programs: WeChat Pay can be integrated with mini-apps for bookings, loyalty, or marketing

In-app marketing: Merchants can launch targeted offers directly to Chinese users

Seamless checkout: Customers can stay within their WeChat app to complete the payment

Alipay: China’s Leading Digital Wallet

Alipay is China’s leading digital wallet, operated by Ant Group (an affiliate of Alibaba). It’s used by over 1.3 billion users globally, including in key markets across Asia, Europe, and North America.

What makes Alipay different is that it goes beyond just payments. the app powers a wide range of services including wealth management, investing, ride hailing, travel booking, and more through a super-app interface.

That level of daily engagement builds real brand loyalty. So when Alipay users shop abroad, they innately look for businesses that support the same seamless experience they’re used to back home.

Payment Experience

Similar to WeChat Pay, Alipay users pay by scanning a merchant’s QR code or presenting one. Transactions are instant, secure, and protected by Alipay’s consumer safeguards.

Both WeChat Pay and Alipay are considered debit wallets, meaning they link directly to a user’s bank account or preloaded balance, rather than functioning like a credit card. When a payment is made, the funds are instantly withdrawn from the user’s account or wallet balance, offering a fast, secure, and transparent transaction.

International Reach

Alipay also supports RMB-to-local currency settlement, making it easy for Canadian merchants to receive CAD payments while still serving Chinese users in their native environment. Businesses can tap into:

Higher average order value from Chinese travelers

Full integration with AlphaPay terminals and eCommerce platforms

Multilingual receipts and currency conversion

Access to Alipay marketing campaigns and user targeting

UnionPay: China’s Global Network

UnionPay, also known as China UnionPay, is China’s only domestic bank card association that is similar to Visa or Mastercard in structure but much larger in scale, with over 7 billion cards issued worldwide.

UnionPay has evolved from a card-only provider to a mobile-first payment ecosystem, offering UnionPay QR code payments and support for mobile wallets.

Types of UnionPay Transactions:

EMV Card Payments: Chip and PIN transactions accepted on standard terminals

QR Payments: Scan-to-pay mobile payments via the UnionPay app

QuickPass: Contactless card and mobile transactions supported globally

Canadian Businesses Accepting Union Pay

For many international shoppers, UnionPay is their primary payment method, not Visa or Mastercard. Seeing the UnionPay logo signals familiarity, trust, and payment compatibility.

Accepting UnionPay allow Canadian merchants to:

Access to seasonal promotions driven by UnionPay

International Opportunity to tap into exclusive loyalty programs

AlphaPay integration across Moneris, Chase, Clover, Global Payments, and more

Why These Payment Platforms Matter in Canada

Growing Chinese Tourism

Despite pandemic-related slowdowns, Chinese tourism to Canada is recovering. According to Destination Canada, Chinese visitors consistently rank among the top spenders per capita, averaging over $2,900 per trip.

Increasing Mobile Wallet Adoption

In China, more than 90% of in-person payments are now mobile, which are made primarily through WeChat Pay and Alipay. These users arrive in Canada expecting the same seamless experience.

Impact on Business Performance:

+15% increase in transaction value when QR options are offered (Retail TouchPoints)

+30% increase in conversion on websites supporting RMB and Alipay

Stronger loyalty and repeat business from culturally aligned service

How AlphaPay Makes It Easy

AlphaPay enables Canadian businesses to accept WeChat Pay, Alipay, and UnionPay through:

Seamless all-in-one POS integration (Moneris, Clover, Chase, Global Payments, Elavon)

Simple onboarding and account setup

Real-time FX settlement in CAD

Seamless integration to existing checkout systems

Omnichannel support including in-store, eCommerce, and mobile payments

Ready to Expand Your Payment Options?

Let AlphaPay help you connect with global customers through trusted, integrated payment solutions.

Get in touch with our team to start accepting WeChat Pay, Alipay, and UnionPay today.