Cross-border payments are financial transactions where the sender and recipient are in different countries. For Canadian merchants, this typically means accepting payments from international customers in their local currencies, then receiving the funds in CAD. These transactions can involve multiple intermediaries, currencies, and systems, which makes speed, cost, and reliability critical factors.

What’s In This Article:

Cross border payments

How do cross border payments work

What to consider

Bank transfer

Bank wire transfer

Cross border payments vs. wire transfers

What AlphaPay can do

Cross-Border Payments

In a world that’s more connected than ever, Canadian businesses are increasingly serving customers far beyond their own borders. Whether it’s a tourist shopping in-store or someone placing an online order from overseas, getting paid across currencies and countries is now a part of everyday business.

In simple terms, it’s when money moves from one country to another, For example, when a Canadian business pays a supplier in China, or when a tourist from the U.S. pays for something online from a store in Japan.

Types of Cross-Border Payments

Bank transfers (wire transfers) – Direct transfers between international bank accounts through networks like SWIFT.

Card payments – Payments made using credit or debit cards issued in one country and used in another.

Digital wallets and fintech platforms – Services like PayPal, Alipay, and WeChat Pay that simplify international transactions and currency conversion.

Remittances – Personal money transfers, often sent by individuals to family members abroad.

Cross-border payments can involve exchange rate fees, varying regulations, longer settlement times, and security checks. However, modern payment gateways and open banking technologies are making these transactions faster, cheaper, and more transparent.

How Do Cross-Border Payments Work?

At its simplest, a cross-border payment happens when money moves from a buyer in one country to a business in another. Cross-border payments often involve several intermediaries such as local banks, correspondent banks, and payment networks. These intermediaries handle currency conversion, compliance checks, and settlement, which can make the process slower or more expensive than a domestic transaction.

What to Consider

Cross-border payments can involve exchange rate fees, varying regulations, longer settlement times, and security checks. However, modern payment gateways and open banking technologies are making these transactions faster, cheaper, and more transparent.

Bank Transfer

A bank transfer is a way to move money electronically from one bank account to another. It can happen between accounts at the same bank or across different banks, domestically or internationally.

An international bank transfer often involves multiple banks, currency exchange, and unclear timelines. Even if the customer sends the money today, it could take several days (and a few unexpected fees) before you actually see it in your account.

How it Works

When you initiate a bank transfer, your bank sends payment instructions to the receiving bank through a secure network (like SWIFT for international transfers or Interac e-Transfer for Canadian domestic ones). The banks then verify the sender, confirm available funds, and complete the transfer by crediting the recipient’s account.

Common Types of Bank Transfers

Domestic transfers – Money moves between banks within the same country. These are usually fast and inexpensive.

International transfers (wire transfers) – Money moves between banks in different countries. These can take a few days and often involve currency conversion and fees.

ACH or EFT transfers – Automated systems used for payroll, bill payments, and recurring transactions.

我们的优势

Secure and traceable

No need for cash or cheques

Can be used for large amounts

Things to Note

Bank transfers can sometimes involve fees, exchange rate markups, or processing delays, especially when sent across borders or through multiple intermediary banks.

Bank Wire Transfer

A bank wire transfer is a specific type of bank transfer used to send money electronically and securely between banks, especially across long distances or international borders. It’s often used for large payments, business transactions, or international remittances.

How a Wire Transfer Works

When you send a wire transfer, your bank transmits payment instructions to the recipient’s bank through a secure messaging network — most commonly SWIFT (Society for Worldwide Interbank Financial Telecommunication).

Here’s what typically happens:

You provide the recipient’s name, bank name, account number, and sometimes a SWIFT/BIC code.

Your bank sends a payment message through the network.

The receiving bank verifies the details and deposits the money into the recipient’s account.

Unlike card payments, the money moves directly between banks, without a payment processor in between.

Domestic vs. International Wire Transfers

Domestic wires are sent within the same country and usually clear within a few hours.

International wires go through correspondent banks and may take 1–5 business days, depending on time zones, bank relationships, and compliance checks.

Pros

Fast and secure for large or high-value payments

Widely accepted globally

Funds are directly deposited into the recipient’s account

Cons

Typically comes with higher fees (both for the sender and sometimes the receiver)

Exchange rate markups can apply for different currencies

Once sent, wire transfers are difficult to reverse

In short, a wire transfer is the most established and secure way to move money internationally, though modern payment platforms offer faster and more cost-effective alternatives.

Cross-Border Payments vs. Wire Transfers

While both cross-border payments and wire transfers involve sending money internationally, they aren’t the same thing. A wire transfer is one method of making a cross-border payment, but there are now many other options that can be faster, cheaper, and more flexible.

All wire transfers are cross-border payments, but not all cross-border payments are wire transfers. Wire transfers rely on banks and legacy systems, while cross-border payments today can move through digital, multi-rail networks that are faster, smarter, and more cost-efficient.

使用场

Cross-border payments: Ideal for businesses that need to pay international suppliers, freelancers, or customers, or accept global online payments.

Wire transfers: Commonly used for large-value transactions like real estate payments, corporate deals, or international tuition fees.

What AlphaPay Can Do

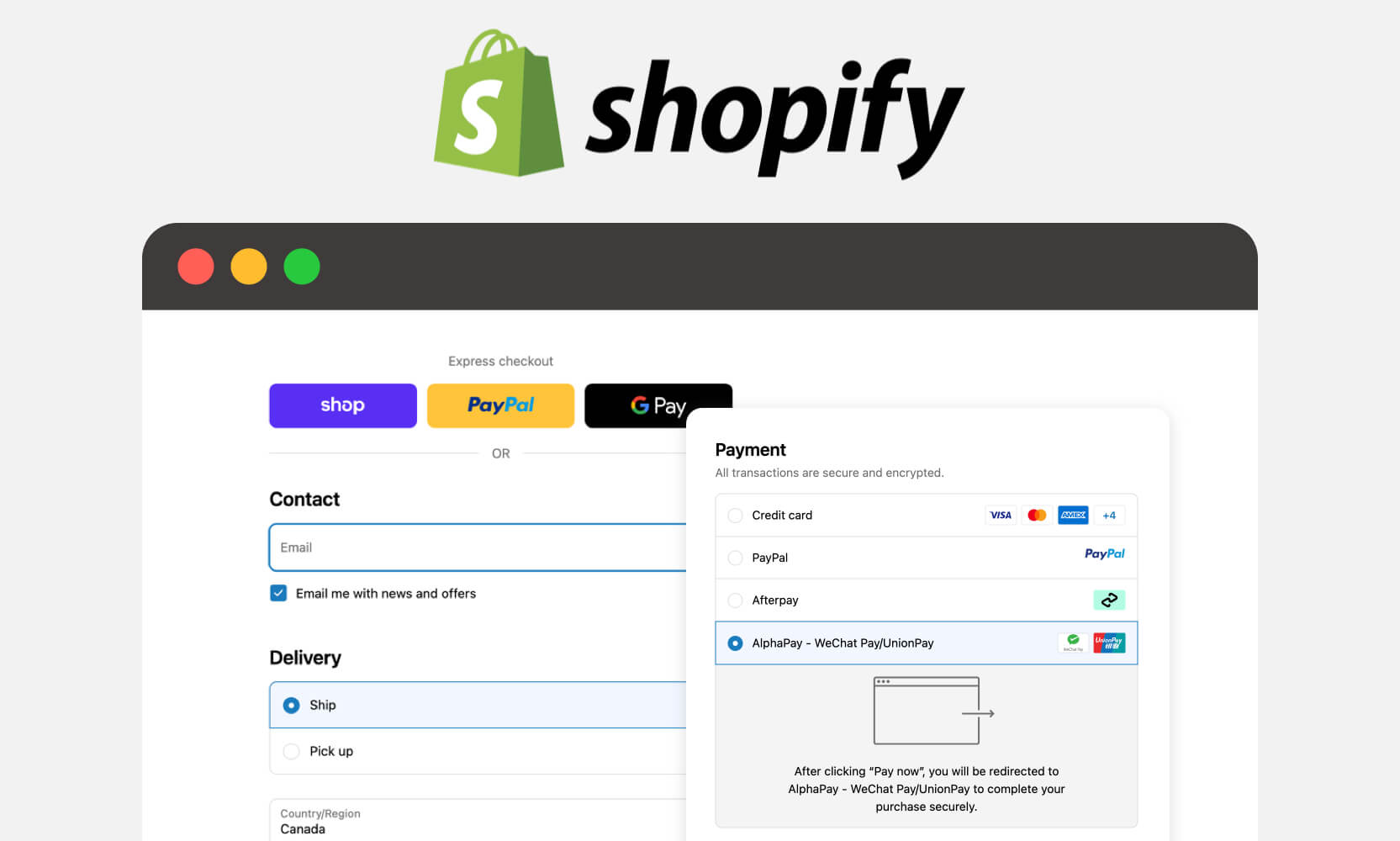

AlphaPay is a cross-border payment platform that connects Canadian merchants with international customers by enabling them to pay using their preferred local payment methods like WeChat Pay, Alipay, and UnionPay. Whether you operate online, in-store, or both, AlphaPay offers an all-in-one solution that simplifies global payments while improving customer experience and business performance.

AlphaPay Can Help

Accept Global Payments Locally: Let international customers pay in the way they’re used to—with familiar mobile wallets and QR code payments—while you receive fast settlements in Canadian dollars, directly to your bank account.

Speed up reconciliation: AlphaPay’s dashboard make it easy to match payments to specific timeframe and sales channels, removing the guesswork from your bookkeeping.

Streamline in-store and online payments: AlphaPay integrates with your existing POS systems like Clover, Moneris, Chase, and plugins for your ecommerce platform, allowing you to offer a seamless, unified experience for customers no matter how they shop.

Reach more global customers: By offering the payment methods that hundreds of millions of consumers use every day, you’ll open your business to one of the world’s biggest spending markets.

Grow with a trusted partner: As the official Canadian strategic partner of WeChat Pay, Alipay, and UnionPay, AlphaPay gives you direct access to global networks, local marketing support, and the infrastructure to scale internationally.

Explore what it means to accept cross border payments with AlphaPay—or connect with our team to get started.