This guide breaks down what “all-in-one” actually includes, what it’s great at, where it can struggle, and a practical way to decide if it’s the right fit for your business or industry.

In This Article:

- What is an all-in-one pos

- The costs and trade-offs

- How to decide it its right for your business

- Industry-by-industry

- When all-in-one might not be the best choice

Suitability score

What Is an All-in-One POS?

A point-of-sale system used to be simple: a cash register, a receipt printer, and a way to take cards. “POS” often means the software and hardware that run your front counter 和 keep the rest of your operation moving including inventory, staff, customer profiles, reporting, and payments.

An all-in-one POS bundles those pieces into a single platform, usually from one primary vendor. That can be a big win: fewer moving parts, fewer logins, one support line, and a smoother day-to-day. But it can also be a trade-off: less flexibility, more vendor lock-in, and limits when your workflows get specialized.

An all-in-one POS typically combines:

POS software (front counter + back office)

Checkout, discounts, returns/refunds, tips (if relevant)

Product catalog, modifiers, barcode scanning, receipts

Staff permissions, roles, shift tracking

Basic customer profiles, loyalty hooks, and promos

Reporting dashboards (sales, SKUs, categories, staff performance)

Payments (built in or tightly integrated)

Card present and card not present

Digital wallets, tap, chip, swipe

Settlements, payouts, and transaction reporting

Hardware ecosystem

Terminal/tablet, card reader, scanner, cash drawer, printer

Sometimes kitchen display systems, self-checkout stations, or handhelds

Add-ons that aim to replace separate systems

Inventory management and purchase orders

Online ordering / pickup / delivery integrations

Appointment booking (for service businesses)

Multi-location management

Basic CRM, marketing, and loyalty

The key idea: one platform is responsible for most of the operational “spine” of your business, not just the moment of payment.

All-in-One vs. “Best-of-Breed” Stacks

A helpful way to think about it:

All-in-one POS is like a single toolbox designed to cover 80–90% of common needs with consistent workflows.

Best-of-breed is building your own stack: POS + separate inventory + separate loyalty + separate accounting connector + separate payment gateway.

When all-in-one tends to win

You want to launch quickly with fewer integration projects.

You don’t have a dedicated IT team.

Your workflows are “standard” for your industry.

You value simplicity over custom features.

When modular stacks tend to win

You need deep, specialized features (complex inventory, custom pricing, regulated workflows).

You already run a mature back office (ERP/accounting/BI) and you just need the POS to plug in.

You want the freedom to swap parts of the system without replacing everything.

The Benefits Beyond Convenience

All-in-one at the counter

When everything is built to work together, staff training is faster and mistakes drop. That’s not a small thing—checkout friction shows up as longer lines, more voids, more “manager override” moments, and more customer drop-off.

Sales, returns, taxes, tips, and payout reporting don’t have to be reconciled across multiple systems. The more systems you stitch together, the more time you spend matching numbers.

Fewer vendors, fewer “not our problem” loops

When something breaks in a modular stack, you can end up stuck between vendors. All-in-one setups often reduce that ping-pong.

Faster rollout across locations

If you’re opening new stores, standardization is a superpower. A repeatable playbook beats a bespoke setup every time.

The Costs and Trade-offs

Vendor lock-in

When your POS, payments, and hardware are tightly bundled, switching can feel like moving houses, not rearranging furniture. Exports may be limited, workflows may be proprietary, and the costs of retraining can be significant.

Specialized industries may hit limits faster

If you need advanced matrix inventory, complex production, regulated workflows, or heavy customization, some all-in-one POS tools can feel restrictive.

Payments flexibility varies

Some platforms require you to use their payment processing. Others let you bring a payment partner. This matters if you need:

specific digital wallets,

negotiated rates,

multi-currency settlement,

or industry-specific risk controls.

How to Decide If It’s Right for Your Business

Follow this decision framework that works across industries.

Map your “must-not-break” workflows

Start with the non-negotiables:

Returns and refund rules

Split payments, partial payments, deposits

Tips/service charges (if applicable)

Discounts/promos, gift cards

Inventory adjustments, waste, bundles/kits

Tax handling (multiple tax rules, exemptions)

Multi-location pricing and transfers

If a POS can’t handle your “must-not-break” workflows cleanly, it won’t matter how beautiful the dashboard is.

Check whether you industry standard

Two coffee shops can need totally different systems:

One sells 20 SKUs and wants speed.

The other is a roaster with wholesale, subscriptions, and batch tracking.

If your business model is close to the industry “median,” all-in-one is usually a strong fit. If you’re doing something unusual, test harder.

Be honest about your appetite for integrations

Integrations are not “set and forget.” They require:

setup,

monitoring,

version changes,

and someone who owns the relationship when something fails.

If you don’t want that overhead, lean toward all-in-one.

Evaluate reporting and reconciliation like a finance lead would

Ask to see:

daily sales reports,

payout/settlement reports,

fee breakdowns,

refunds/chargebacks,

and multi-location rollups.

Also ask how data exports work and whether you can automate accounting workflows.

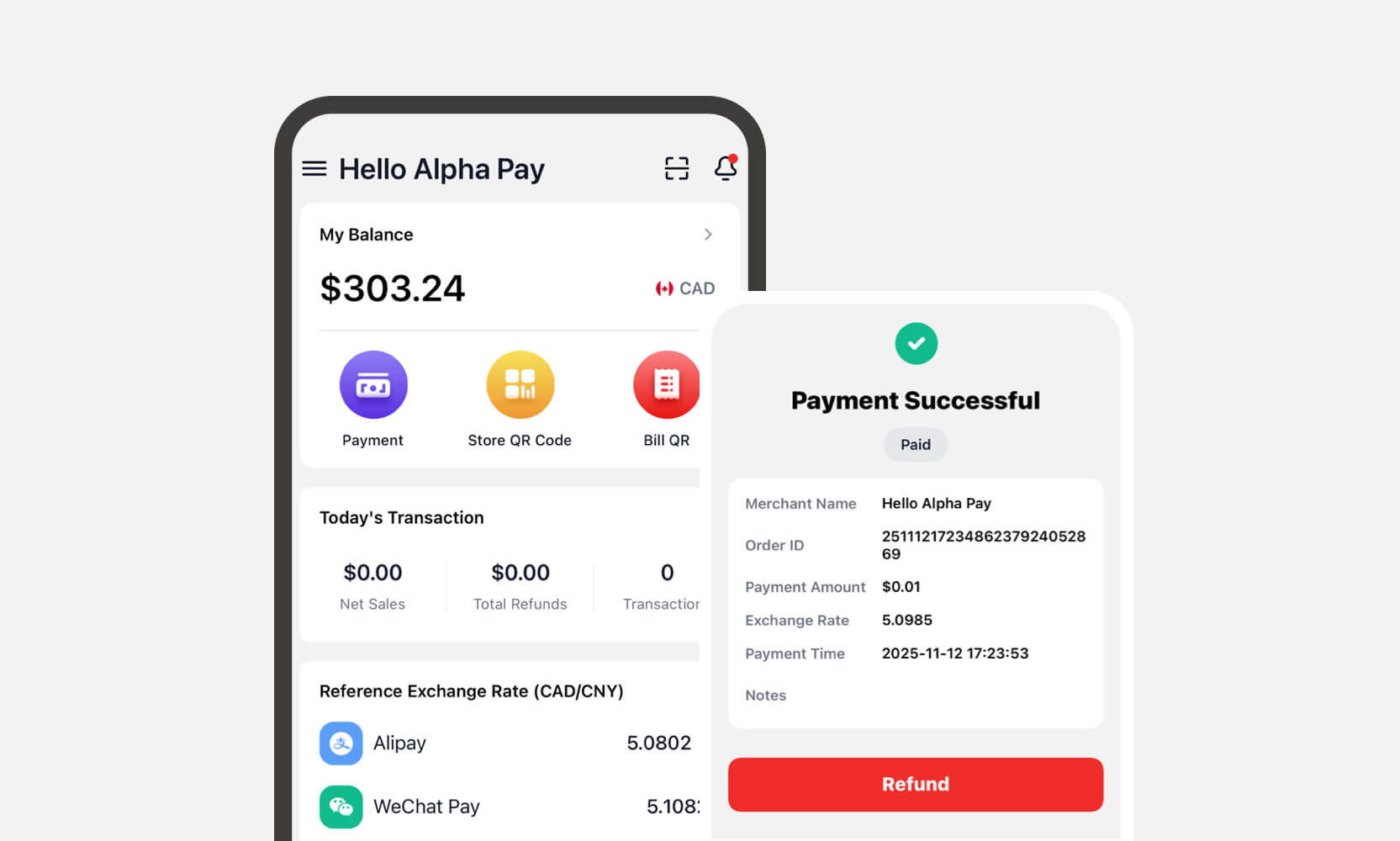

For cross-border or digital wallet acceptance, it’s especially important that reporting is clean and trackable. AlphaPay, for example, emphasizes customized transaction reporting and reconciliation access via a merchant management portal.

Confirm uptime, offline behavior, and support

A POS is mission-critical. Ask:

uptime history and SLA,

what happens during internet outages,

how incidents are monitored,

and support response times.

(Example: AlphaPay references average minimum uptime commitments and monitoring/incident alerting for its payment interface. )

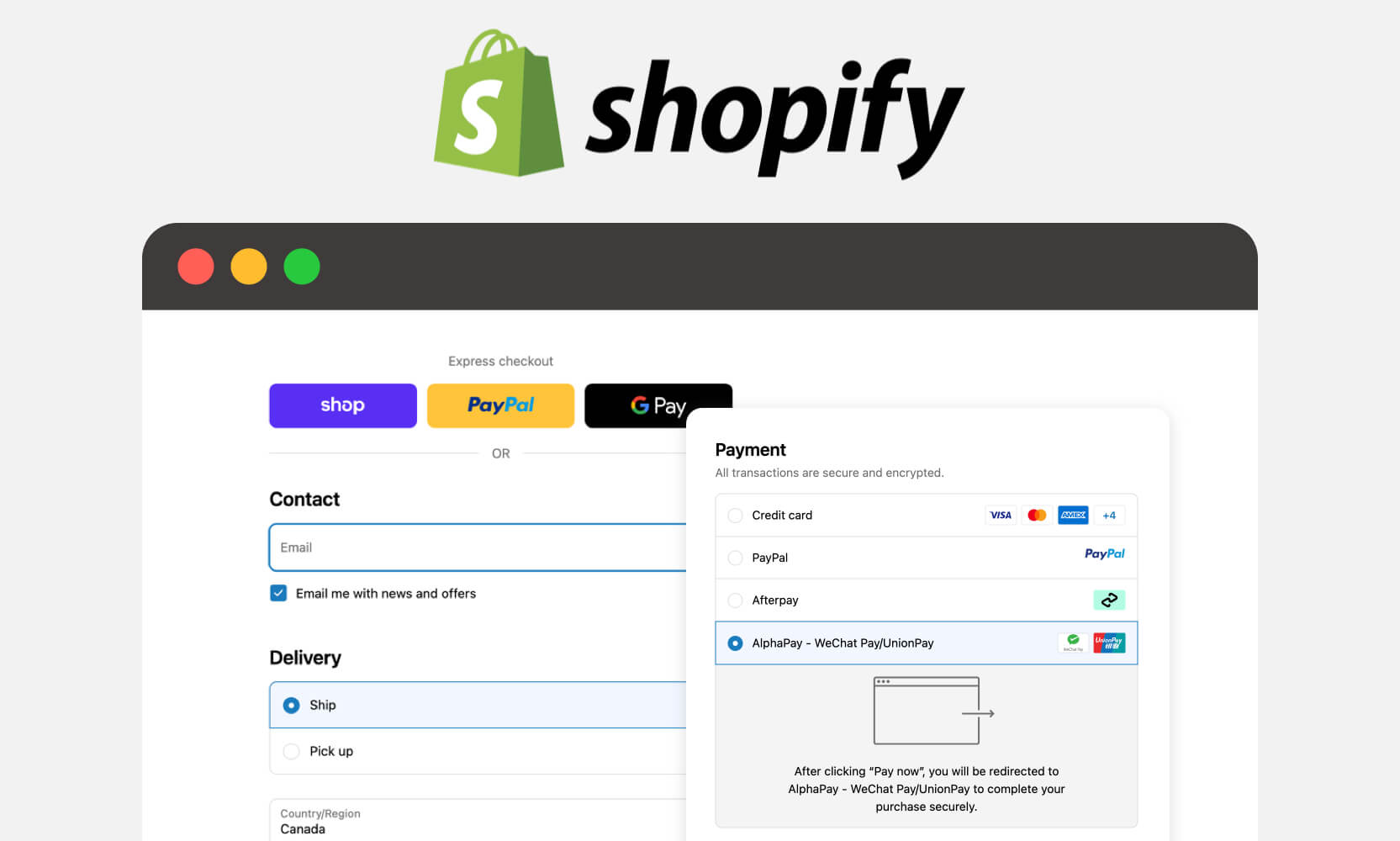

Payments to match your customer base

If you serve tourists, international students, or cross-border shoppers, “standard cards only” can leave money on the table. If accepting Alipay, WeChat Pay, or UnionPay matters to you, make sure the POS can support it either natively or through a clean integration path. AlphaPay describes in-store and e-commerce integrations for these wallets, including scanner-based flows that keep checkout quick.

Total cost of ownership (TCO): look past the sticker price

Build your real monthly cost:

POS subscription(s)

payment processing fees

hardware financing/warranty

add-on modules (loyalty, online ordering, etc.)

integration costs (one-time + ongoing)

support tiers

contract length and cancellation fees

Then add the soft costs:

staff training time

slower checkout during the transition

downtime risk

reporting/reconciliation labor

Industry-by-Industry: Where All-in-One Works Best

Quick-service restaurants and cafes

All-in-one is often ideal when speed matters more than deep customization. Look for:

fast item modifiers,

tipping,

kitchen workflows (if needed),

and easy menu updates.

Retail (single location to small chains)

Great fit when you want:

barcode scanning,

basic inventory,

purchase orders,

customer profiles,

and simple promotions.

Salons, spas, fitness studios

All-in-one helps if appointments, staff scheduling, and memberships are part of your daily operation. Just confirm the booking experience is actually strong, not an afterthought.

Grocery and high-SKU environments

Some all-in-one POS systems handle high SKU counts well; others struggle with advanced inventory, frequent price changes, or complex reconciliation. If you have self-checkout or specialized lane hardware, validate the POS can meet those requirements or can integrate with what you already run.

Omnichannel brands (in-store + online)

All-in-one can be a big advantage when it genuinely unifies inventory and customer data across channels. If “unified” means “two separate modules that barely talk,” you’ll feel it quickly.

When All-in-One Might Not Be the Best Choice

You should be more skeptical if:

You’re an enterprise with a complex ERP and strict IT governance.

You need heavy customization, unique pricing logic, or deep manufacturing/production tracking.

Your industry is highly regulated and requires specific audit trails.

You already have best-in-class systems that work and you only need a payment/checkout layer.

In these cases, a POS that plays nicely with integrations can be a better long-term approach.

One pattern that works well: keep your existing POS workflows, and integrate additional payment methods through a provider that minimizes operational disruption. AlphaPay’s materials describe integrating mobile payments into existing cashier and self-checkout systems while reducing retraining and keeping the flow simple (scan-to-pay, fast transaction times).

Calculate With a Suitability Score

Give yourself 1 point for each “yes”:

Our workflows are fairly standard for our industry.

We don’t want to manage multiple vendor integrations.

We need to launch or upgrade quickly.

We want consistent reporting without manual reconciliation.

We’re adding locations or planning to scale.

Our team prefers simple training and repeatable operations.

Our current POS is painful enough that switching is worth it.

Our payment needs are covered by the platform (or cleanly integrable).

6–8 points: all-in-one is likely a strong fit.

3–5 points: could work, but test integrations and edge cases carefully.

0–2 points: you may be better with a modular approach or an integration-first strategy.

What’s Next

An all-in-one POS is a strong choice when you want fewer moving parts, faster rollout, and consistent operations—especially if your workflows are standard and your team values simplicity.

It’s a weaker choice when your business is operationally unique, heavily regulated, or already supported by advanced back-office systems that you don’t want to replace.

If you’re ready to explore all-in-one pos options for your business or want to understand what’s possible, reach out to our team for a quick demo!