In this guide, we walk you through everything you need to know about POS terminals—from what they are and how they work to choosing the right type for your business and evaluating costs.

For Canadian merchants, choosing the right point-of-sale (POS) terminal is a strategic investment that affects your day-to-day operations, customer satisfaction, and long-term growth.

From liquor stores to cafes and restaurants, a modern POS system can help you work faster, and serve better. In this guide, we’ll break down the essentials of POS terminals: how they work, which type suits your business, and what to consider before choosing one.

What Is a POS Terminal?

A POS terminal is the device that lets you complete in-person transactions. It reads cards, mobile wallets, and QR codes, connects to payment processors, and issues receipts. But modern POS systems do much more.

Modern systems are all-in-one solutions that also help manage inventory, track sales, generate reports, and support digital loyalty programs. With global shoppers on the rise, a POS terminal that can accept cross-border payments like Alipay, WeChat Pay, and UnionPay is quickly becoming essential.

Types of POS Terminals

- Fixed POS Terminals

Stationary systems often used at checkout counters. Ideal for high-volume environments like liquor stores or restaurants with consistent in-store traffic. - Mobile POS

Portable, tablet- or smartphone-based terminals. Great for wineries, outdoor events, and businesses that need flexibility. - Cloud-Based POS

Connects to the internet and stores data securely in the cloud. Useful for multi-location retailers needing centralized control and real-time access to data. - Smart POS

Combines multiple functions in one device: accepts chip, tap, mobile wallets, and QR payments, while also managing receipts, loyalty programs, and customer insights.

What to Consider When Choosing a POS Terminal

- Payment Options

Does the terminal support debit, credit, mobile wallets, and QR code payments? Systems that accommodate Alipay, WeChat Pay, and UnionPay help you serve international customers with ease. - Hardware Quality

Choose equipment that suits your setting—durable for high-traffic liquor stores, weather-resistant for outdoor wineries, or compact for mobile setups. - Software Capabilities

Look for features like real-time reporting, inventory tracking, employee management, and integration with your CRM or loyalty platform. - Compatibility

Ensure it works with your existing tools. AlphaPay integrates seamlessly with leading platforms like Moneris, Clover, and Chase. - Security Standards

Make sure the POS terminal complies with PCI DSS and supports encryption and tokenization to keep customer data secure.

Cost of a POS System

Software Costs

POS software is typically offered as a subscription:

- Entry-level plans can start from low monthly fees, ideal for basic needs.

- More advanced plans with added functionality (like inventory, reporting, or staff management) can climb into the mid- to high hundreds per month, depending on the provider and business size.

Some cloud-based systems offer free or low-cost software, charging per transaction instead of a flat monthly fee.

Hardware Costs

POS hardware costs vary widely based on what you need:

- Mobile card readers are the most affordable and portable option.

- Full countertop terminals (with touchscreens, printers, and customer-facing displays) fall in a higher price range but offer more functionality.

- All-in-one systems, which include a terminal, cash drawer, and receipt printer, are ideal for retail and restaurant settings looking for a clean, centralized setup.

If you’re not ready to commit to a large upfront investment, many providers offer hardware rentals, typically charged on a monthly basis.

These plans often include ongoing support, software access, and maintenance, making them a practical option for growing businesses.

Upfront vs Subscription Models

Some businesses prefer to purchase hardware outright and a one-time software license. Others opt for a subscription model, where they rent the equipment and pay ongoing software and service fees.

Which model is right for you depends on your cash flow, business stage, and how much flexibility you need.

Processing Fees

In addition to hardware and software, you’ll pay payment processing fees. These are typically a percentage of each transaction, often around the 2% range, plus a small fixed fee per purchase.

Make sure to evaluate this cost carefully, especially if you deal with high volumes or large average transactions.

POS Hardware Options

Here are some representative systems available in Canada:

Clover Station Duo

Clover Flex/Flex Pocket

Moneris Go

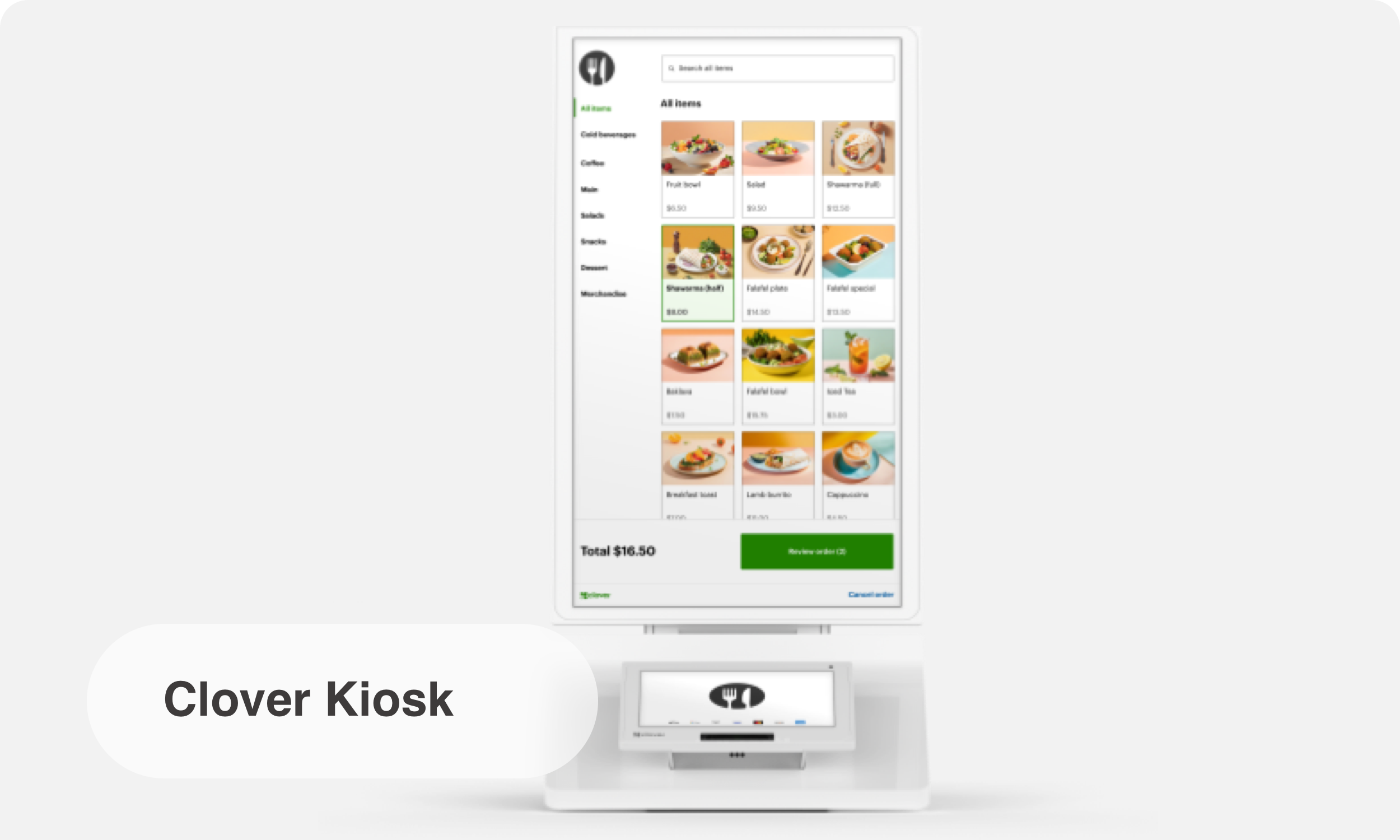

Clover Kiosk

Countertop Terminals

- Clover Station Duo: Modern all-in-one POS for retail and restaurants with customer-facing display, built-in receipt printer, and fast processing. Great for high-volume environments.

Mobile & Handheld Terminals

- Clover Flex Terminal: Compact, all-in-one smart terminal with touchscreen display, built-in receipt printer, and full AlphaPay compatibility. A strong fit for counter service environments and merchants who want modern functionality without added hardware.

- Moneris Go Terminal: Compact and user-friendly, the Moneris Go features a touchscreen interface, built-in receipt printer, and wireless connectivity. Ideal for businesses that want a sleek, portable solution without sacrificing functionality.

Retail Focused

- Moneris Go Retail: A compact, secure terminal designed for countertop use with advanced connectivity options and AlphaPay compatibility.

- Ingenico Move/5000: A handheld, Wi-Fi enabled terminal offering secure tap, chip, and QR code payments with AlphaPay support.

Self-service kiosk

- Clover Kiosk: A full-service self-ordering terminal designed for restaurants and fast-paced retail. Customers can browse, order, and pay independently, reducing wait times and improving efficiency.

High Volume Businesses

- Global Payments Integrated POS: Custom-configured systems suited for multi-location or large-format businesses. Perfect for handling high traffic and complex operations.

Choose based on your business size, setup needs, and transaction volume. All of these systems support AlphaPay’s global wallet integration with no extra software fees.

Benefits of Modern POS Terminals

Faster, smoother transactions

Broader payment acceptance, including mobile and cross-border options

Improved inventory control and sales tracking

Enhanced customer experience

Scalable features for growing businesses

Get Started with the Right POS

Choosing the right POS system allows you to better meet customer expectations, enabling modern payments, and supporting your business as it grows. AlphaPay can help you find a terminal that fits your needs and sets you up for long-term success.

With full integration for cross-border payments like Alipay, WeChat Pay, and UnionPay, our POS solutions are designed to help you serve global customers in Canada.

Ready to apply?

Get in touch today and we’ll help you get started with an option that works for your business.