Frequently Asked Questions

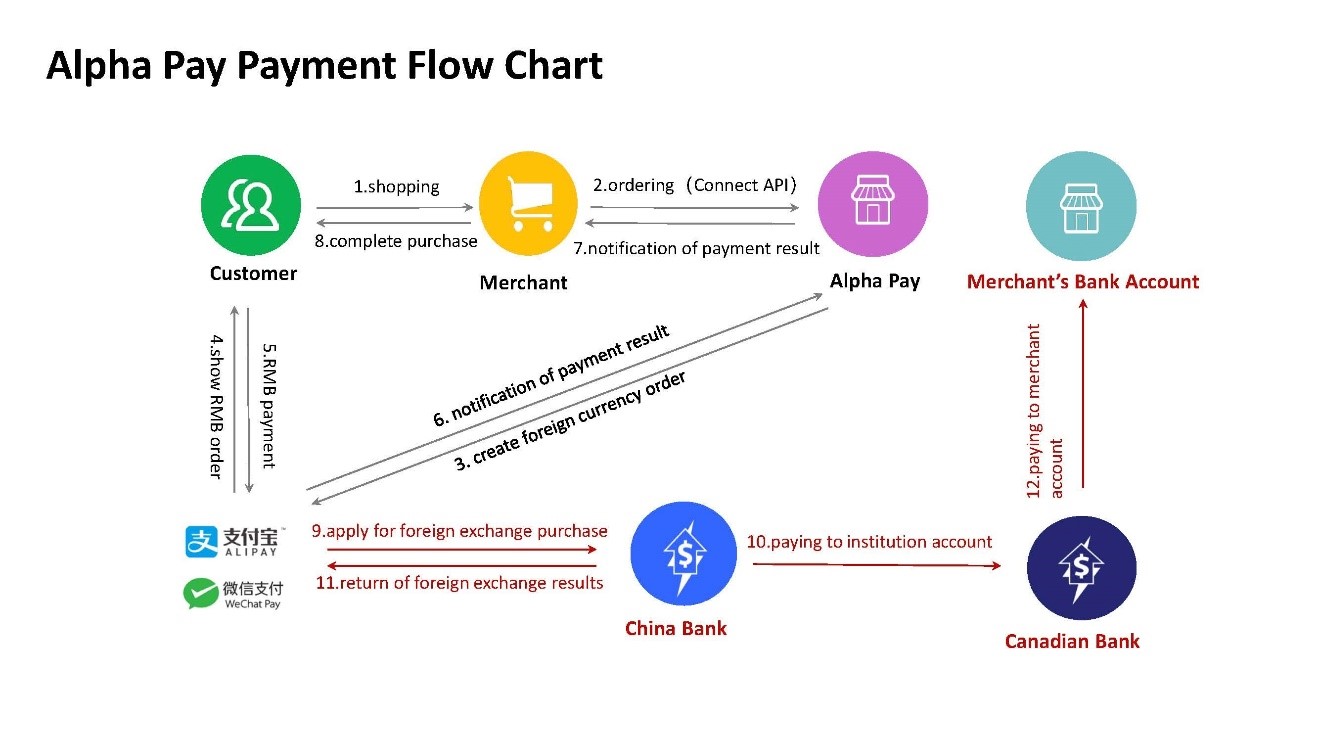

A: Customer pays merchant by RMB directly from their China bank account at real-time exchange rate with WeChat or Alipay. Tencent settles the RMB to Alpha Pay then Alpha Pay settles to the merchant’s designated Canadian bank account in CAD.

A: Merchant does not have to bear any exchange rate difference in case rates fluctuate before settlement. The customer pays merchant at the real-time exchange rate provided by Tencent who will settle at the same rate.

A: T+2 (2 business days), settlement days can be manually set to T+1, T+3, weekly or monthly.

A: No, there is no service fee

A: Alpha Pay signs up with both SME (small-medium enterprises) as well as national accounts. Examples of clients are: T&T Supermarket

A: Alpha Pay does not charge any additional handling other than the service fee of each transaction.

A: The service fee will be charged on every single successful payment transaction and the amount will be deducted directly upon settlement of payment to the merchant’s bank account per transaction.

A: It depends on the individual, usually 10,000 per transaction.

A: Yes, Merchant can access to the back office or Alpha Pay APP to download monthly statement

A: With WeChat & Alipay & UnionPay, chargeback does not exist just like the debit transactions. Same as fraud, the consumer is responsible for safeguarding their payment and is 100% liable for all fraud.

A: Yes, AlphaPay has PCI Compliance Certification.

A: WeChat & Alipay transactions are auto cut off at 12:00 am PST. No manual day-end closing of transaction is needed.