In 2025, Chinese tourists are expected to spend over USD 1.6 billion in Canada, largely through mobile wallets like Alipay, WeChat Pay, and UnionPay.

The way people pay is changing. QR codes, mobile wallets, and real-time transactions are becoming the norm, especially for international consumers. But beneath every tap, scan, or swipe is a system that makes the payment actually happen: a gateway and a processor.

If you’re a business accepting digital payments (or planning to) it’s worth understanding how this infrastructure works, and how the right setup can reduce friction, improve security, and unlock new customer segments.

What Is a Payment Processor?

A payment processor is the infrastructure behind every digital transaction. It connects your business, your customer’s bank, and your payment gateway to move funds securely from one account to another.

Whether a customer pays by card, digital wallet, or QR code, the processor ensures the transaction is authorized, approved, and settled. It’s the engine that powers the payment—quietly working in the background.

What Do Payment Processors Do?

Payment processors manage the full lifecycle of a transaction, including:

-

Routing the payment: Communicating between your point-of-sale system or website and the customer’s issuing bank.

-

Verifying the transaction: Checking for fraud, insufficient funds, or red flags.

-

Requesting authorization: Ensuring the bank approves the payment before it’s confirmed.

-

Managing settlement: Transferring the funds to your business account, often in your preferred currency.

Processors also handle currency conversion, chargebacks, and dispute resolution—especially important when accepting payments from international customers.

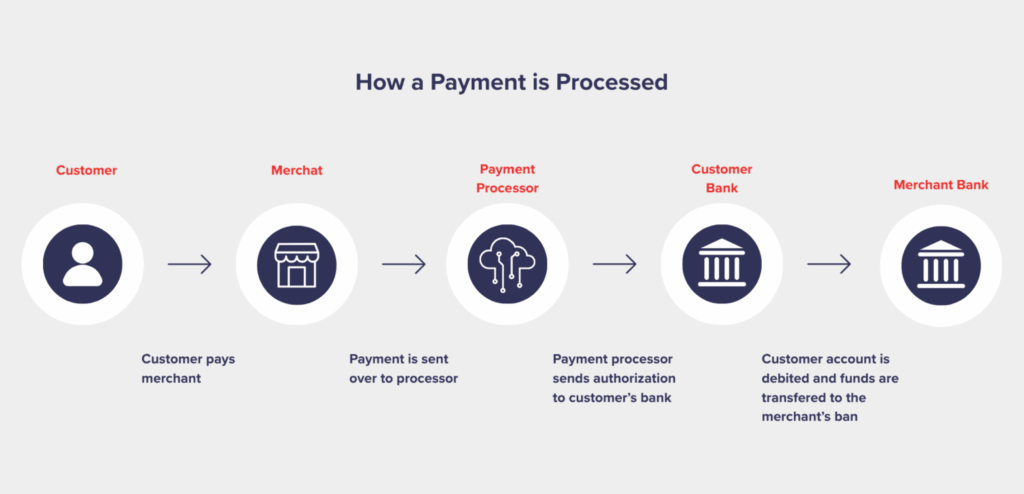

How Do Payment Processors Work?

Let’s break it down:

-

A customer initiates a payment either by card, tap, QR, or online checkout.

-

The payment gateway captures the payment information and sends it securely to the processor.

-

The processor validates the transaction, communicates with the customer’s bank, and requests authorization.

-

Once approved, the processor moves the funds into your business account.

-

You and your customer receive instant confirmation.

If you’re using AlphaPay, this entire process is handled within a single ecosystem. Whether it’s Alipay, WeChat Pay, UnionPay QR, or card payments, AlphaPay processes everything seamlessly—converting currencies and settling payments in CAD, typically within 1–2 business days.

How to Choose a Payment Processor

Choosing the right processor depends on your customers, your sales channels, and your operational needs. Here are key factors to consider:

1. Payment Method Coverage

Does it support the payment types your customers actually use? If you’re targeting international visitors you’ll want mobile wallet support like Alipay and WeChat Pay.

2. Settlement and Currency Handling

Can it handle foreign currencies and convert them to CAD without delays or hidden fees?

3. Ease of Integration

Is it compatible with your existing POS or e-commerce platform? Can you get started quickly with minimal setup?

4. Security and Compliance

Look for PCI DSS compliance, fraud prevention tools, and secure authentication processes.

5. Added Value

Does it offer more than just payment processing such as customer insights, marketing tools, or discoverability in travel directories?

Payment Gateway vs. Processor

At its core, a payment gateway securely captures customer payment information and passes it to the payment processor, which handles the transaction itself—authorizing the charge, transferring funds, and communicating between banks.

Most modern platforms combine these functions. For example, AlphaPay serves as both the gateway and the processor, ensuring everything from QR code capture to CAD settlement is handled in one system.

Infrastructure That Meets Customers Where They Are

AlphaPay allows businesses to accept these payment methods both online and in-store—without having to overhaul their systems. That might mean:

-

A QR code by the register

-

Integration into an existing POS

-

A payment link embedded in an invoice

-

A plugin for your e-commerce platform

Regardless of how the payment is made, the backend stays consistent: the customer pays in RMB, you receive CAD, and funds are settled automatically within a few business days. No foreign exchange stress, no reconciliation complexity.

More Than Just a Transaction

Payments aren’t just the last step in the customer journey—they’re often a starting point for loyalty and engagement.

Through AlphaPay, merchants can tap into Alipay and WeChat’s marketing ecosystems, getting featured in travel directories, surfacing geo-targeted offers, and reaching consumers before they’ve even arrived in the country. It’s infrastructure with visibility built in.

Built for Scale and Simplicity

AlphaPay handles compliance, risk checks, and currency conversion behind the scenes, so merchants can stay focused on their customers. With no monthly fees and full support from a Canadian team, it’s a payment stack built for local businesses with global reach.

The Bottom Line

The payment experience matters. And the infrastructure behind it shapes what your business can offer—not just at checkout, but across the entire customer journey.

By using a gateway and processor that’s optimized for international mobile wallets, you’re not just accepting payments. You’re making your business discoverable, accessible, and ready for what’s next.

Explore AlphaPay’s payment solutions or connect with our team to get started.