Payment networks are the invisible infrastructure that makes modern commerce possible. Every time someone taps a card, checks out online, or transfers money between accounts, these networks quietly route information and funds between the right financial institutions.

In This Article

- What is a payment network

- What is a card network

- How card networks work

- Card network vs payment networks

What is a Payment Network?

A payment network is a standardized system that allows banks, merchants, and consumers to move money electronically. It sets the rules for how funds are transferred, authenticated, and settled between participants.

Each network has its own architecture, processing speed, and geographic reach. Some are designed for near-instant transfers, while others batch transactions to keep costs lower. The unifying goal across all payment networks is interoperability—ensuring that money can move smoothly between different banks, systems, and even countries.

Types of Payment Networks

Network Type | Definition |

|---|---|

Card-based networks | Used for debit and credit card payments; route transactions between issuing and acquiring banks. |

Bank-based networks | Examples include ACH in the United States, SEPA in Europe, and Interac in Canada. These systems transfer funds directly between accounts, often in batch cycles. |

Real-time payment networks | Rails like India’s UPI or the U.S. RTP Network allow 24/7 instant transfers. They’re becoming the backbone of digital economies where speed is a key advantage. |

Mobile wallet networks | Apple Pay, Google Pay, Alipay, and WeChat Pay sit on top of existing rails, combining convenience, authentication, and contactless or QR-based transactions. |

What is a Card Network?

Card networks are one specific type of payment network. They facilitate electronic payments made with credit, debit, or prepaid cards.

When a customer uses a card, the card network’s job is to transmit data between the merchant’s bank (the acquirer) and the customer’s bank (the issuer). The network verifies the transaction, ensures there are available funds or credit, and then passes the authorization back to the merchant—all in a fraction of a second.

Main Global Card Networks

Network | Structure | Notes |

|---|---|---|

Visa | Open network | Partners with thousands of issuing and acquiring banks worldwide. |

Mastercard | Open network | Competes closely with Visa; operates in over 200 countries. |

American Express | Closed network | Acts as both issuer and network, maintaining tighter control over its ecosystem. |

Discover | Closed network | Similar to Amex, with strong presence in the U.S. and some international reach. |

UnionPay | Open network | Dominant in China, expanding across Asia and Europe. |

JCB | Open network | Japan-based, widely accepted across Asia-Pacific. |

How Card Networks Work

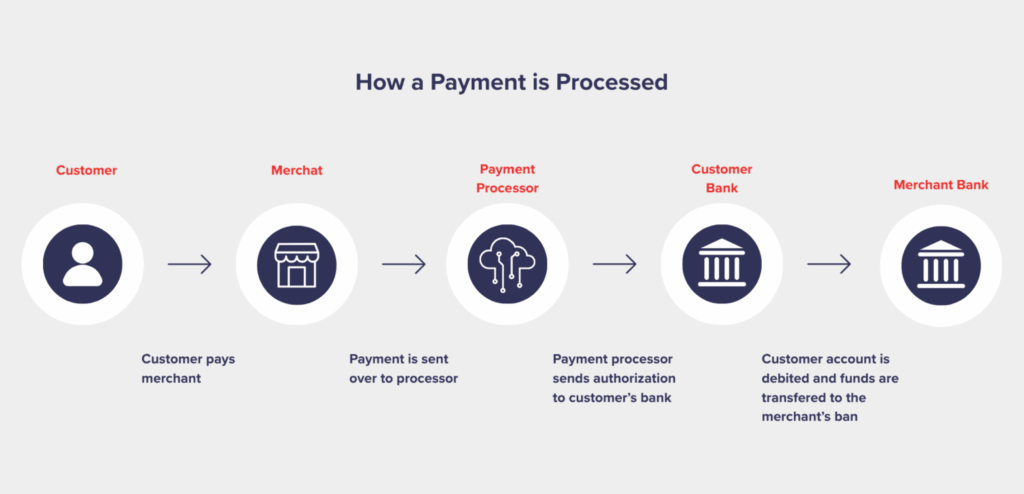

The typical card transaction involves several key participants:

Cardholder – the consumer making the purchase.

Merchant – the business accepting the payment.

Acquirer – the merchant’s bank or payment processor.

Card Network – routes the transaction between parties and enforces rules.

Issuer – the cardholder’s bank.

The payment flow:

The customer presents their card to make a purchase.

The merchant’s system sends the transaction details to the acquirer.

The acquirer forwards the information through the card network.

The network routes it to the issuing bank for authorization.

The issuer verifies the details, approves or declines, and sends the response back through the network to the merchant.

Once approved, settlement occurs—funds move from issuer to acquirer, then to the merchant’s account.

This happens in seconds, but behind it is a complex, standardized infrastructure ensuring speed, trust, and global reach.

Card Networks vs Payment Networks

All card networks are payment networks, but not all payment networks are card networks.

Card networks specialize in facilitating transactions tied to cards, while payment networks can include direct account transfers, real-time payments, and alternative payment methods like QR codes or mobile wallets.

For example:

Visa and Mastercard are card networks.

Interac, SEPA, and UPI are payment networks.

Alipay and Apple Pay are payment layers that sit on top of these networks, combining convenience, authentication, and access to multiple funding sources.

Why This Matters

Understanding the difference helps businesses in evaluating payment partners, transaction fees, and processing times. Card networks tend to have higher fees due to interchange and fraud protection costs, but they offer global acceptance. Bank-based payment networks and real-time rails can lower costs and accelerate settlement but may lack the same international reach.

In short, card networks built the foundation for digital payments as we know them, while newer payment networks are expanding what’s possible—faster transfers, open APIs, and cross-border interoperability. Together, they form the infrastructure of a global economy where money moves as easily as information.