Category: Blog

More Chinese tourists are returning to Canada, and many of them are heading straight

Tencent(WeChat) and Alibaba workers stay home working Tencent, which is also based in Shenzhen,

WeChat Official Account Background There are 98% of Chinese are now using mobile phone.

With a 200% ROI(Return on Investment), WeChat featured GAP as a case study to

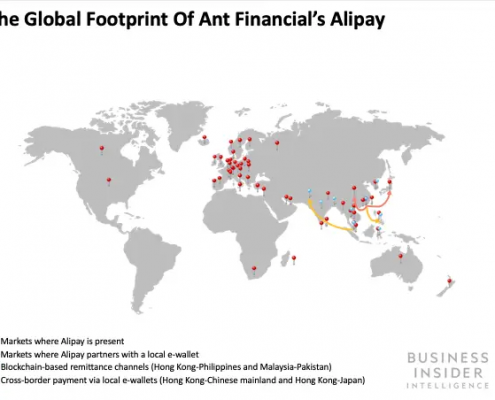

AlphaPay works closely with “Discovery” platform on Alipay’s mobile app, which allows Chinese outbound

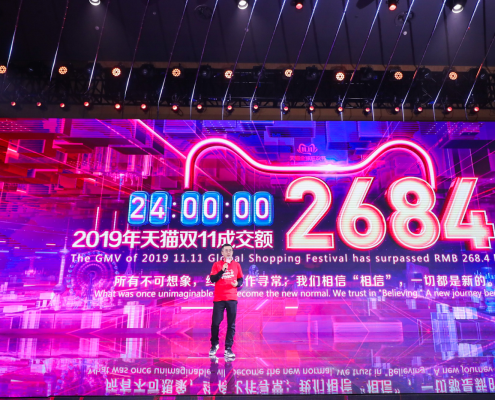

Fan Jiang, President of Taobao and Tmall, at the 2019 11.11 Global Shopping Festival

Support for QR code payments is growing within the payments industry. In mid-2017, AlphaPay

WeChat Pay pursues an international expansion strategy As a digital wallet service of China’s

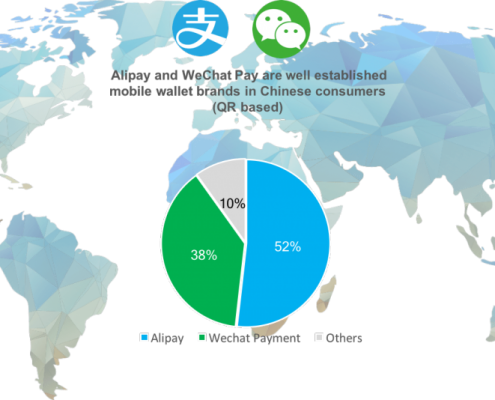

December 17, 2019 11:09 AM Eastern Standard Time DUBLIN—In China, Alipay has a market